Easy News: Budget

Easy News: Budget

In this edition:

-

1: Benefits and work

-

Some people who receive Personal Independence Payment (PIP) will have their payments reviewed less often from April 2026.

-

The Department of Work and Pensions will do more Work Capability Assessments. This means disabled people on Universal Credit will have their award assessed more often.

-

The Government will offer more employment support to disabled people who are not in work and receive unemployment benefits.

-

Some makes of cars will no longer be available through the Motability Scheme. This includes makes like BMW and Mercedes.

-

The Motability Scheme rents cars to disabled people at a cheaper rate than normal. Many disabled people say this change will make it harder for them to find vehicles that will meet their accessibility needs.

-

Other changes to the Motability Scheme made in the Budget will make the price some people pay go up.

-

The minimum wage for people over 21 is rising from £12.21 to £12.71 per hour. For people aged 18 to 20, it is rising from £10 to £10.85.

-

Training for apprentices aged 24 or less will be free for small and medium-sized companies.

-

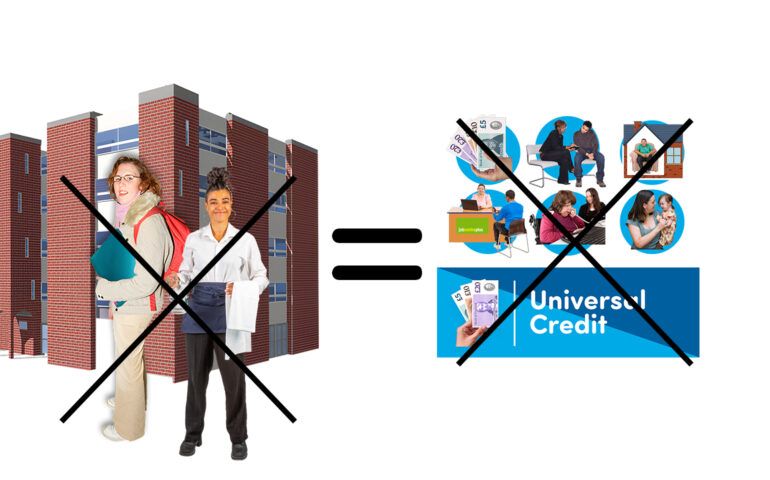

People who are between 18 and 21 years old who are on Universal Credit may be made to take 6-month paid work placements.

-

After 18 months, if they are not in job or school, they will be offered a placement. If they do not take it, their Universal Credit will be stopped.

-

The 2-child benefit cap will be removed in April. This was a limit that meant families could only receive Universal Credit or Child Tax Credits for up to 2 children.

-

-

2: Taxes

-

The National Insurance and Income tax thresholds will stay the same until 2031.

-

National Insurance is Government tax on the money people are paid for the work they do and is paid by both workers and employers.

-

It pays for state benefits, including pensions, the NHS and unemployment benefits.

-

Income tax is a tax on the money people are paid for the work they do, as well as the money they make from savings or dividends.

-

Dividends are payments made by companies to people who own parts of the company through things called shares.

-

People who get paid more for the work they do will pay more tax than people who are paid less.

-

Keeping the tax thresholds the same for 3 years means that people in 2028 will be taxed based on what their money was worth in 2025.

-

But because inflation means the prices people pay for things goes up over time, this change could actually mean people will have less money to spend.

-

In England, people whose house is worth £2million or more will have to pay extra in Council Tax.

-

This is a tax charged on homes by local councils to fund local services, such as schools, police, outside areas and rubbish collections.

-

From April 2028, there will be a new tax for electric cars based on how far they drive, at around 3 pence per mile.

-

-

3: Savings and pensions

-

The amount of money people under 65 can put into a cash ISA will be limited to £12,000 a year from April 2027.

-

An ISA is a type of bank account where the bank can invest the money and pays you interest on it. ISA stands for Individual Saving Account.

-

State pension payments will go up by 4.8% on April, more than the rate of inflation. A state pension is money paid by the Government every 4 weeks to people over 66 years old.

-

The Help to Save scheme, which helps people on Universal Credit to save money, will be offered to more people after 2027.

-

Train ticket prices will stay at the same price. With inflation, this means they will become cheaper.

-

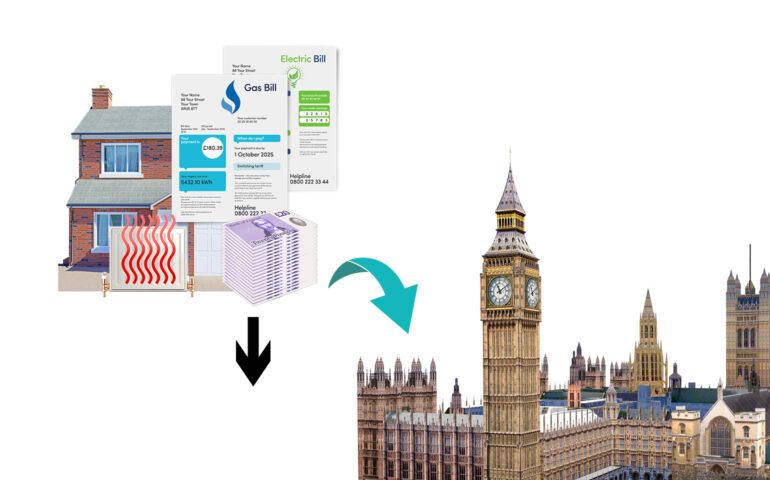

Green Levies will be taken off energy bills. This means people will be taxed less on the energy they use to heat their home, by around £88. Green Levies are taxes put on products that are bad for the environment.

-