Easy read newspaper by people with learning disabilities and autism to roll out regular online updates

Disability charity United Response will translate more frequent standalone stories into easy read and publish them on its website as part of its flagship Easy News newspaper, which has been running since 2013.

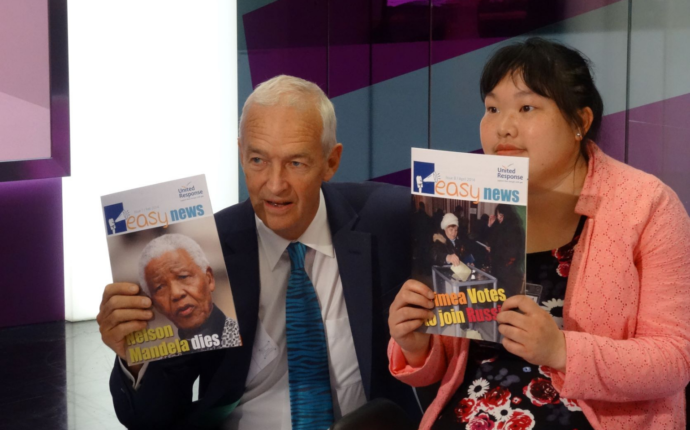

The much-read newspaper, which in 2014 appeared on Channel 4 News to mark its one-year anniversary, has traditionally been produced every two to three months as a roundup of recent world and domestic news from a time period sometimes spanning more than 10 weeks.

Once printed and distributed, it is now hosted solely online due to ongoing funding challenges.

The move to a regular rolling news service aims to ensure that the most current and topical events are made as accessible and available to people with learning disabilities as possible, as well as to others who benefit from easy read resources – such as those with English as a second language.

Our Easy News ‘consultants’ – news editors with learning disabilities or autism supported by United Response – have been praised for covering sensitive and challenging topics this year, including the Israeli-Palestine conflict and the 10-year anniversary of the abuse at learning disability hospital Winterbourne View.

We are committed to ensuring those with learning disabilities or autism are informed about the world which surrounds them, and our many easy read resources are at the heart of this commitment.

As well as the longstanding Easy News, the first-ever newspaper of its type, we have recently produced easy-read materials to help make voting and politics more accessible to marginalised people.

This included accessible political party manifestos ahead of the 2019 General Election but also practice ballot papers for the key local and mayoral UK elections this May.

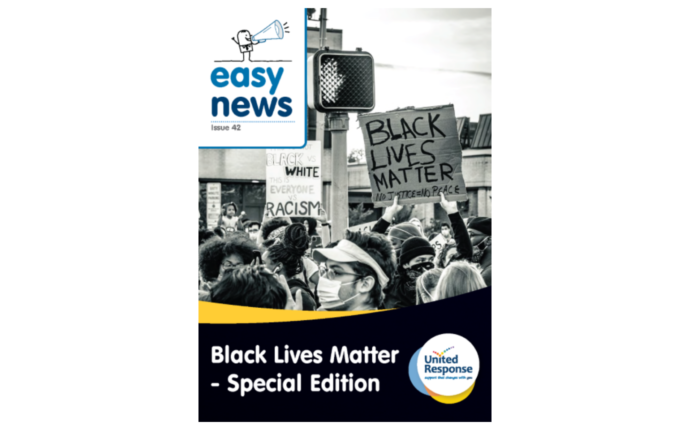

United Response also last year published in-depth looks at Coronavirus and the Black Lives Matter movement, as part of Easy News ‘special editions’.

We are committed to ensuring those with learning disabilities or autism are informed about the world which surrounds them, and our easy read resources are at the heart of this commitment.

Alicia Hurn, United Response job coach in Manchester, said:

We are so incredibly proud of how Easy News has transformed the way people with learning disabilities and autism can access and understand the news.

Being able to source and digest information is something so many of us take for granted, but it is so much harder for many people – including those we support.

Easy News has been cutting through the complex since 2013, making some of the biggest stories of the past eight years easier to understand.

We’d love to print and post every edition like we used to but that’s presently not possible. Instead, we’re changing how we produce it to meet the demands of the present-day news cycle and to make stories even more readily available to disabled people than they once were.

Rahman, one of the Easy News editors, said:

It is much better to have stories each week, for example, which are more up-to-date than when it [Easy News] was published every other months.

Ben, another editor, added:

Easy News makes tough topics easier to understand. I am glad to be involved with easy read and to inform and educate our readers.

Easy News was previously a printed product, delivered to home addresses and placed in local shared spaces such as libraries and community hubs. Without funding or external support, the newspaper will remain an online product only for the foreseeable future – limiting its reach and value.

If you would like to donate to United Response to help it print its valuable easy read resources, including Easy News, please visit unitedresponse.org.uk/get-involved/donate

[give_form id=”2787″]